- #Where do i mail my 1065 tax form how to#

- #Where do i mail my 1065 tax form pdf#

- #Where do i mail my 1065 tax form free#

Tax forms such as W2s, W3s, FUTA tax return, Form 114, Form 720, Form 940, and Form 941 may be necessary as well. Some of these may include a profit and loss statement, balance sheet, deductible expenses, and cost of goods sold. Collect Relevant Documentsįirst off, you’ll need to gather a number of important financial and tax documents.

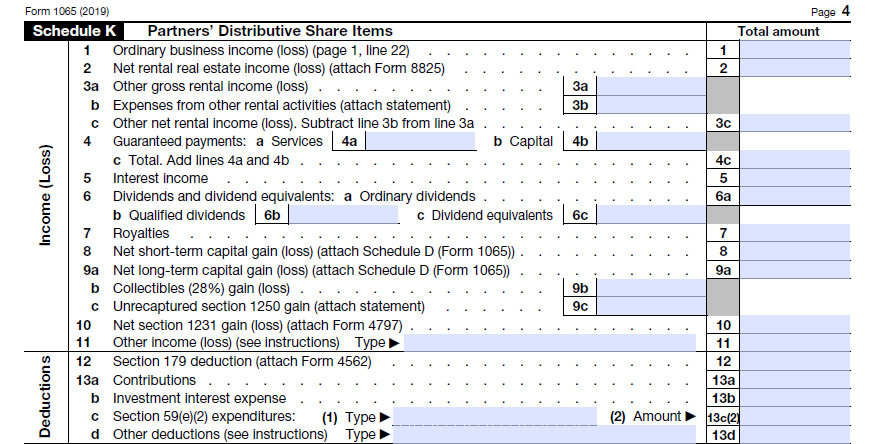

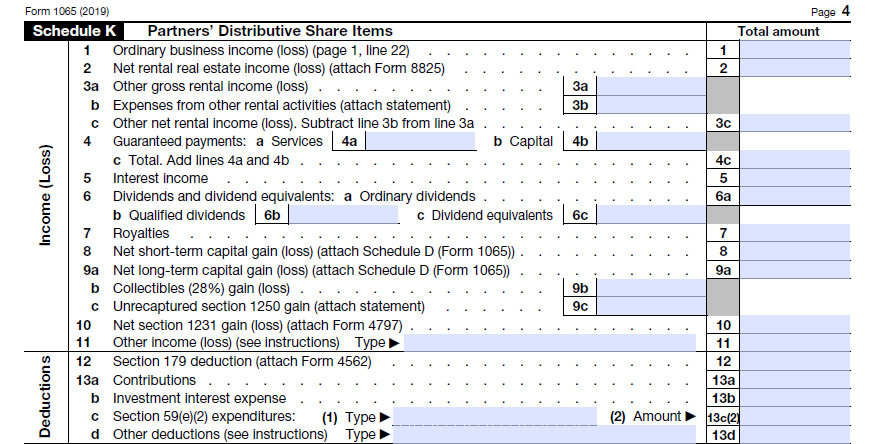

Without further ado, here are the filing instructions. It will ask you for a variety of information from several financial and tax documents. Before we get started, however, you should know that IRS Form 1065 is a five page document that you can fill out online or by hand.

If you’re wondering how to file a Form 1065, you’re in luck because we’ll give you step-by-step instructions.

Foreign partnership: If your business is foreign but you earn more than $20,000 in annual gross income from U.S. 501(d): You likely have a 501(d) if your non-profit organization is religious or apostolic. LLC: If your LLC has been classified as a partnership and you have not filed a Form 2553 to be treated as a corporation, you’re on the hook for an IRS Form 1065. Domestic partnership: According to the IRS, a domestic partnership is a “relationship between two or more persons who join to carry on a business with each person contributing property, money, or skill.”. Since IRS Form 1065 is a business-entity form, you must complete every taxable year if you are a: It’s an essential part of being a small business owner and must be completed if you’d like to avoid tax issues down the road. So, why is it important? By filing a Form 1065, the IRS can verify that you and your partners have paid their taxes correctly. You won’t owe any taxes on an IRS 1065 Form. Keep reading for more details on Schedule K-1. You’ll file the Schedule K-1 with your personal tax return. Therefore, you and the members of your LLC will be required to complete a Schedule K-1 form to report your share of profits and losses. As a pass-through entity, you fill out IRS form 2553 so you only have to pay taxes on your partnership’s income at your own individual income tax rates. Here’s why: A partnership is a pass-through entity that reports its financial information so that partners can enter their share of it on their personal tax returns. However, you won’t use this form to calculate or pay taxes on your income. As the owner of a partnership or LLC, you’ll need to submit this form to the IRS every year. Return of Partnership Income?Įssentially, Form 1065 is an informational form you’ll use to report the business income, gains, losses, income deductions, and credits from your operations. Get started today What Is Form 1065: U.S. Small Business Corporations (S-Corp) Information Report (Rev.Full business credit reports & scores from Dun & Bradstreet, Experian and Equifax. Payment Form and Application for Extension of Time to File Qualified Regenerative Manufacturing Company (QRMC) ReportĬover Sheet for Qualified Regenerative Manufacturing Company (QRMC) Federal ReturnĬombined Group Business Tax Apportionment Qualified Regenerative Manufacturing Company (QRMC) Election Qualified Investment Company (QIC) Report Qualified Investment Company (QIC) Election If you have a substantive question or need assistance completing a form, please contact Taxpayer Services at (603) 230-5920. To request forms, please email or call the Forms Line at (603) 230-5001. Additional details on opening forms can be found here. Adobe provides information on how to adjust your browser settings to view PDFs. Each browser has its own settings to control how PDFs open from a web page.

Please follow the above directions and use a different PDF Reader. Note for Apple users: Apple Preview PDF Reader does not support calculations in forms. Print the form using the 'Print Form' button on the form for best results

(Adobe's Acrobat Reader is free and is the most popular of these programs.)ĥ. Open the form using a PDF Reader that supports the ability to complete and save PDF forms. Choose a location to save the document and click "Save."Ĥ. Select “Save Target As” or “Save Link As.”ģ. Right click on the title link of the form you want to save.Ģ. You may also save the form as a PDF to your computer, complete the form, and then print and mail the form to the address listed.ġ.

To achieve the best results, we recommend the latest version of both your web browser and Adobe Acrobat Reader. An alternative print version of most forms are available that have limited functionality but may be easier to open.  The following forms are fillable PDF forms which can be opened, completed, and saved. To sort forms by "Form Number" or "Name/Description", click on that item in the table header.

The following forms are fillable PDF forms which can be opened, completed, and saved. To sort forms by "Form Number" or "Name/Description", click on that item in the table header.

0 kommentar(er)

0 kommentar(er)